Project Forecast: Why it is Important Not to Confuse Actual Changes and Productivity Issues

We have found repeatedly in our consulting interventions that Project-driven organizations often confuse a number of causes for variances to the Project forecast. Astonishingly, this happens even in established and recognized organizations. This results in misunderstandings as to the reasons for deviations of the project forecast outcome. As a result, corrective actions taken by Project Management can be significantly delayed and have a very poor effectiveness. Our new White Paper 2014-13 ‘Understand Project Forecast Variances: Why it is Important Not to Confuse Actual Changes, Productivity Issues and Materialization of Risks‘ investigates this essential issue.

Natural Variation is part of any process. Think of this curve as representing the level of effort to produce a given deliverable. Variations happen naturally around some average. Yet nothing was changed!

When executing a Project, a number of situations can lead to changes of the project outcome – either in terms of cost or schedule:

- Changes – to the project scope or even simply to the project execution plan, due either to internal choice or to external request,

- Materialization of (external) opportunities or risks,

- Variances that are not due to either changes or risks, and that are simply the result of differences with the expected productivity of resources, bid estimation errors, the result

of mistakes or unexpected rework, external market conditions, duplicate ordering of material etc.

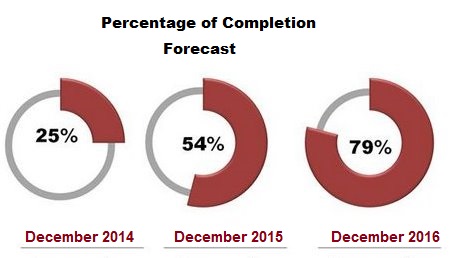

Many organizations unfortunately confuse the causes of forecast variance by allocating all variances to Changes. This results in great confusion. In particular, the most critical issue we observe is late recognition of forecast variance due to requirements to treat them as changes and hence go through a lengthy approval process.

On one side, an effective Management of Change practice covering all internal Changes irrespective if their contractual status is critical for project teams to early identify the relevant potential variance enabling the teams to take proactive measures and efficiently manage the business.

On the other side, proper segregation of the causes of forecast variances is then essential to effective action-taking. Confusing all variances with Changes is deeply misleading and adds other issues in particular, frequent lag in the recognition of actual variances, or inability to fully apprehend productivity issues at a time where something can still be done about them.

Understand this essential issue in our new White Paper 2014-13 ‘Understand Project Forecast Variances: Why it is Important Not to Confuse Actual Changes, Productivity Issues and Materialization of Risks‘ released today!

Find all these principles of Project Cost Control exposed in a comprehensive manner in our new Handbook,  Practical Project Cost Control for Project Managers (now published – click on the link to see it on Amazon!)

Practical Project Cost Control for Project Managers (now published – click on the link to see it on Amazon!)

Thanks to Kamlesh Narwani for the challenging exchanges on the draft of this White Paper.