How to Deal with the Complication of Cost Control for Multi-Entity, Multi-Currency International Projects

Most Large, Complex Projects are executed nowadays in an international environment. Sometimes the contract given to a Contractor is split into several contracts for several entities often located in different countries. At the same time, multiple currencies are often used both for revenue and expenditure. Being able to manage effectively this additional complexity and take advantage of it is a substantial competitive edge for international contractors, where maturity of processes and systems is essential for success. Our new White Paper 2014-12 on Multi-Currency, Multi-Entity Cost Control explains the basics that need to be followed.

The White Paper tackles in particular the following key issues:

The White Paper tackles in particular the following key issues:

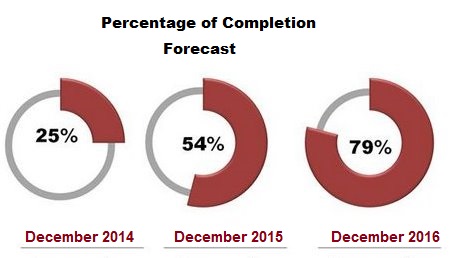

- How overall Percentage of Completion accounting needs to be implemented, and not a Percentage of Completion accounting separate per entity; and how to deal with the accruals that result,

- How multi-currency issues have to be managed, and what are the different ways to protect oneself against currency fluctuations – natural hedging and contractual hedging, and what are the advantages and drawbacks of each method.

Mature international contractors distinguish themselves by being able to manage the complication of multicontract, multi-currency situations through adequate systems and processes.

Multiple contracting entities and multiple currencies are additional challenges that are often unavoidable in the performance of international contracts, in particular in certain countries. Specific control and accounting approaches must be used. If they are not implemented, profit might be recognized imprudently too early and significant impacts can happen from changes in currency exchange rates. This has led many upcoming project-driven organizations in difficult situations with respect to their investors or clients. Surprises created because of these issues denote poor control of project operations. Learn how to overcome these issues in our new White Paper 2014-12 on Multi-Currency, Multi-Entity Cost Control !

Find all these principles of Project Cost Control exposed in a comprehensive manner in our new Handbook,  Practical Project Cost Control for Project Managers (now published – click on the link to see it on Amazon!)

Practical Project Cost Control for Project Managers (now published – click on the link to see it on Amazon!)

How to Use Cost Reconciliation to Improve Control on your Project

While Accounting and Cost Control functions and processes should be separated (as described in White Paper 2014-02), it is essential to reconcile very regularly the data from these two processes to ensure that your project is under control. In our new White Paper 2014-06 we expose the principles of this reconciliation and the best practices that need to be followed to get the most out of this useful process.

This figure shows the basic principles of reconciliation and the different costs to be considered.

Reconciliation with accounting will give an indication of the quality of the cost tracking on the project (which forms the basis for the forecast). Reconciliation needs to be performed on a monthly basis at the Work Package level, the lowest level of the Cost Breakdown Structure. This is feasible through the consistent implementation of the Cost Breakdown Structure in both the Cost Control and Accounting systems. The difference between Actual Cost and Invoiced Cost values in accounting shall be examined to detect whether the Actual Cost basis is indeed a sound basis for forecasting. Any excessive difference needs to be explained.

A proper reconciliation process allows to benefit fully from these two independent control systems to increase assurance that the project is effectively under control. It needs to be implemented regularly and its conclusions need to be traced. The Project Manager, without being involved in the details, must keep abreast of its results and of possible identification of issues related to project controls that might have been detected. Understand more in our new White Paper 2014-06 “How to Use Reconciliation between Cost Control and Accounting to Improve Control on your Project” how to benefit fully of the reconciliation process!

Find all these principles of Project Cost Control exposed in a comprehensive manner in our new Handbook, Practical Project Cost Control for Project Managers (now published – click on the link to see it on Amazon!)

Practical Project Cost Control for Project Managers (now published – click on the link to see it on Amazon!)