Quantitative risk analysis on large complex projects is often performed using statistical tools based on Monte Carlo approaches, applied for cost and schedule. These approaches can be supplemented by scenario analysis, in which a number of risk and opportunity factors are combined in scenarios of different probabilities of occurrence. Reviewing the consistency of the outcomes of the two techniques will increase the resilience of the risk analysis result. In our new White Paper 2024-01 ‘How to Complement Statistical Quantitative Risk Analysis with Scenarios Approaches’, we examine how scenario analysis can be deployed and how to use its results.

Both scenario analysis and statistical risk analysis are the result of a modelling of the project. A model is a representation of an item that is simplified and generally geared towards a specific purpose. Therefore, the outcomes of those processes are various models of the project, that can be tested and updated using the models’ key parameters and assumptions. The combination of a variety of models based on different sets of mechanisms and assumptions generally allows to better understand reality, as seen from multiple angles. This is the approach proposed.

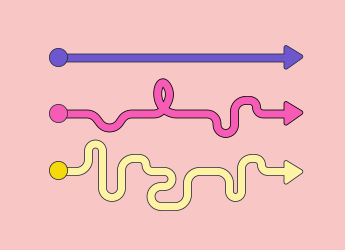

Since the two techniques model the project according to different approaches, the important issue is to check the consistency of the outcomes for similar class of probability. Consistency between the results provided by statistical analysis and scenario analysis will improve confidence in the risk analysis results, while inconsistencies will raise questions to be resolved. In particular, non-linear effects such as ‘cliff effects’ (small variations of parameters leading to substantial changes of the outcome in terms of cost or schedule) or an accumulation of consequential impacts can be much easier identified and modelled in the scenario approach. They will generally not be identified in Monte Carlo analysis, possibly leading to a greater spread of outcomes for the scenarios.

Combining diverse types of risk modelling is useful to improve confidence in contingency. Scenario-based models are useful complements to the usual Monte Carlo approaches and allow to identify specific non-linear effects that may be difficult to apprehend otherwise. Ensuring consistency between the various types of models provides further analysis on possible impacts of risks and opportunities and therefore will enhance the reliability of the quantitative risk process, and thus this approach to combine different types of models is highly recommended. Discover more in our new White Paper 2024-01 ‘How to Complement Statistical Quantitative Risk Analysis with Scenarios Approaches’.

If you can’t access the link to the white paper, copy and paste the following link in your browser: https://www.projectvaluedelivery.com/_library/2024-01_scenario_vs_statistical_v0.pdf