How to Include Digital Physical Progress Measurements in Capital Project Control Setups

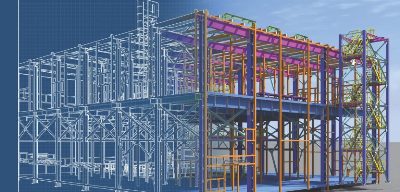

Getting an accurate measure of physical progress is essential to maintain capital projects under control. New technology is getting deployed on projects based on advanced imaging (digital photography, 4D scans, drones) often associated with Artificial Intelligence (AI). This remains an emerging discipline and does not cover the full scope of the project. In our new White Paper 2022-08 ‘How to Include Digital Physical Progress Measurements in Capital Project Control Setups’, we explore the possibilities offered by this new technology and the challenges that must be overcome to include those digital measurements in the overall project control framework.

A reliable measure of physical progress is essential data for knowing the current state of the project (where we are). Having this reliable foundation is also essential for any forecasting activity (where we are heading).

Measuring physical progress requires up-to-date reports on the status of certain indicators identified as representative of physical progress. Two practical problems arise:

- The relevance of the choice of indicators

- The accuracy of the data, which requires quality and reliability of the progress measurement

Digital technology allows us to respond to the immediacy challenge of the availability of data. It can make it possible to significantly increase the data capture frequency. It also allows automatic processing of data (by aggregation, analysis, etc.) provided that it is correctly coded at its origin. Digital can also enable data to be captured at a greater level of detail, closer to operations.

Read our new White Paper 2022-08 ‘How to Include Digital Physical Progress Measurements in Capital Project Control Setups’ for an update on current digital capture technology and on using AI for physical progress measurement. The White Paper also covers issues that need to be overcome to fully benefit from digital capture of physical progress.

Many initiatives exist and some progress is made towards integrating digital physical progress data in project control setups. However, this requires a particular effort at project start-up as the amounts of data thus generated must be specified, coded, and checked to fit into the overall project control setup. Project professionals must recognize that this focus has to be included in project setup plans and that this issue also needs to be addressed in the requirements to the specific contractors and subcontractors that will be involved in the project. Early consideration of such solutions is thus paramount to their successful implementation in projects.

If you can’t access the link to the white paper, copy and paste the following link in your browser: https://www.projectvaluedelivery.com/_library/2022-08_digital_physical_progress_v1.pdf